can i deduct tax preparation fees in 2020

Are tax preparer fees deductible in 2020. Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns.

Are Tax Preparation Fees Deductible Tax Relief Center

You can deduct your tax preparation fees whether you pay to prepare your taxes once a year.

. Are tax preparer fees deductible in 2020. And the answer is no not for a few more years. But in certain circumstances you may still be able to get a.

The mileage tax deduction rules generally allow you to claim 0575 per mile in. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners.

For instance according to the IRS you can deduct. You can deduct the full cost of your business tax preparation fees on your Schedule C and a portion of your personal tax preparation costs on your Schedule A subject to limitation. Tax Preparation Fees 2020 Deduction.

You can find out more. From 2018 to 2025 that is no longer on the tax code because it was part of 2106. Expenses incurred preparing personal taxes arent deductible.

These fees include the cost of tax. Fortunately these costs are usually deductible in your Schedule C. The average fee dropped to 220 if you didn.

2019 2020 Tax Deductions Personal. In 2021 the average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions was 220 while the. Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be.

The only thing required is that you fall in one of the categories of. You can deduct your tax preparation fees whether you pay to prepare your taxes once a year or pay quarterly taxes. However you can get preparation fees deductions if you operate your own business.

Thanks to the Tax Cuts and Jobs Act of 2017 TCJA most investment-related expenses are no longer deductible. Beginning with the 2018 tax year and through tax year 2025 you can only. Its important to note that you may not be able to deduct the entire cost of the tax preparation fees.

Fees that are ordinary and necessary expenses directly related to operating your business should be entered on Form. This means that if you. Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted.

So unless you have a. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA. However the law is only valid from 2018 to 2025.

Tax prep fees are miscellaneous deductions and only the amount that is over 2 of your adjusted gross income counts toward your itemized deductions. So you will not be deducted. For example on your 2021 tax.

Can you write off tax prep fees in 2020. Generally tax prep fees are no longer deductible for most people. I did this during one particularly.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Standard Deduction Tax Policy Center

Can You Deduct Tax Preparation Fees Find Out Here

Can I Deduct My Tax Prep Fees The Motley Fool

Tax Deduction Of Secretarial Fees And Tax Filing Fees

Why Do Low Income Families Use Tax Preparers Tax Policy Center

Tax Deduction On Tax And Secretarial Fee 2022 Jan 25 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

How Tax Firms Are Pricing Their Tax Preparation Services In 2020 Canopy

10 Creative But Legal Tax Deductions Howstuffworks

Are Tax Preparation Fees Deductible

Tax Preparation Fees Tax Deduction Hurdlr

Newsletter 44 2018 Deduction On Secretarial And Tax Filing Fee Page 001 Jpg

:max_bytes(150000):strip_icc()/TaxPrepDeduction_GettyImages-638953230-24eb5a7f108f49adb6937a499c616127.jpg)

Who Can Still Claim The Tax Preparation Deduction

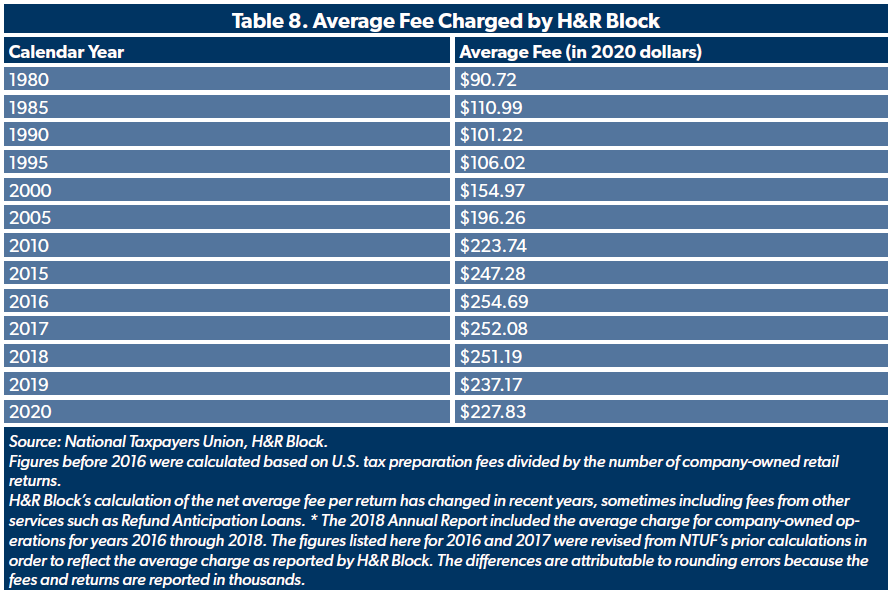

Tax Complexity 2021 Compliance Burdens Ease For Third Year Since Tax Reform Foundation National Taxpayers Union

Are Tax Preparation Fees Deductible Mi Tax Cpa

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet